More than a quarter of wealth management clients worldwide plan to switch their primary provider; the figure is higher among Millennials and in high-growth regions, a survey by EY has found.

Clients also expect to move an increasing slice of investments: 45 per cent plan to shift between a quarter and half of their assets.

The findings come from the EY Global Wealth Research Report, which surveyed nearly 3,600 wealth management clients globally.

Fees

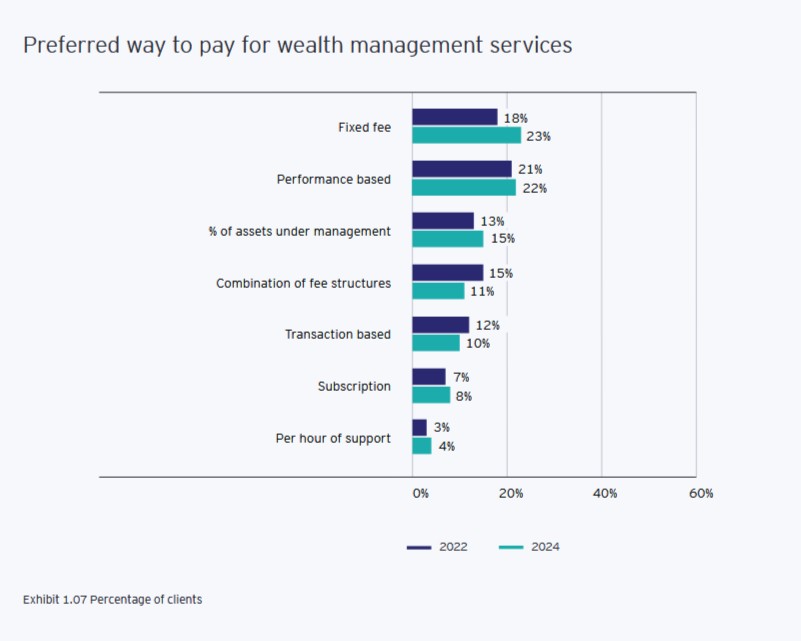

The report said that pricing has become increasingly important to clients over the past decade. Some 34 per cent of clients see lower fees as a key driver for switching advisors, ranking ahead of several factors such as access to specialists, guidance on achieving financial goals, and relationships with individual financial advisors or relationship managers. Fixed fees have become clients’ preferred pricing mechanism for the first time and are the leading choice of affluent investors.

Performance-based fees come a close second and are preferred more frequently by those at the higher end of the HNW bracket and ultra-HNW side. Ad valorem fees based on assets under management are slightly less popular , except for clients in the Middle East .

In other findings, the EY report said that many affluent and HNW individuals are unprepared for inheritance and wealth transfer, struggle to trust AI, and look more to alternative investment options.

Among the main conclusions of the report, it said “clients report strong satisfaction with all key dimensions of wealth management.”

“However, specific client clusters are less satisfied, and the relevance of investment performance in driving satisfaction means that there is no room for complacency,” it said. Growing complexity is an issue: Globally, 45 per cent of clients see investing as having become more complex.

Clients are deeply worried about volatility, inflation, political uncertainty and other macro factors. One in five say their advisors are not addressing their concerns, and one in three feel underprepared to meet their financial goals.

Among top concerns in managing investments and financial wealth globally, economic stability takes the most prominent spot, with 55 per cent overall giving this factor. In Asia-Pacific, 60 per cent said this was their major concern, and 59 per cent of those in the Middle East did so. For North American respondents, the reading was 54 per cent; for Latin America, 56 per cent, and Europe appeared to be least worried on this point, at 51 per cent.

In other “worries,” 52 per cent of all respondents on average cited inflation; 45 per cent said “market volatility”; 43 per cent mentioned “geopolitical risks”; 41 per cent cited “regulation and policy changes”; and 39 per cent referred to “interest rates.”

The survey asked clients how well wealth managers are preparing them for challenges. Overall, 51 per cent of respondents said wealth managers are preparing them “very well” in regulation and policy changes, including tax, and 43 per cent said “somewhat or not at all.” In North America, 36 per cent were positive.

AI has been a dominant theme in wealth management this year, and the EY report is no exception.

Worldwide, most wealthy clients worldwide actively expect wealth managers to incorporate AI into their core activities. Only one-fifth of clients have no expectation for wealth managers to use AI.

The trust implications of AI are explored in the study.

The proportion of clients with a high level of trust in AI is greater in fast-growing regions than in more mature markets .